Contents:

The market state that best suits this type of strategy is stable and volatile. This sort of market environment offers healthy price swings that are constrained within a range. Weekly Forex trading strategies are based on lower position sizes and avoiding excessive risks.

Weekly Forex Forecast (February 27-March 3, 2023) – Daily Price Action

Weekly Forex Forecast (February 27-March 3, .

Posted: Mon, 27 Feb 2023 18:40:00 GMT [source]

Hey Traders, in today’s trading session we are monitoring GBPUSD for a selling opportunity around 1.212 zone, once we will receive any bearish confirmation the trade will be executed. In just one click, you can export and save images (.png) of your graphs (with all your indicators, lines, drawings,…) for later analysis and review. Our platform integrates two tools that automatically generate signals that highlight patterns on your diagram as soon as they occur. Our rates are provided by Teletrader, worldwide financial information provider to institutions like banks, brokers and stock exchanges. At FXStreet traders get interbank rates coming from the systematic selection of data providers that deliver millions of updates per day.

Apa Yang Dimaksud Dengan Trend Forex

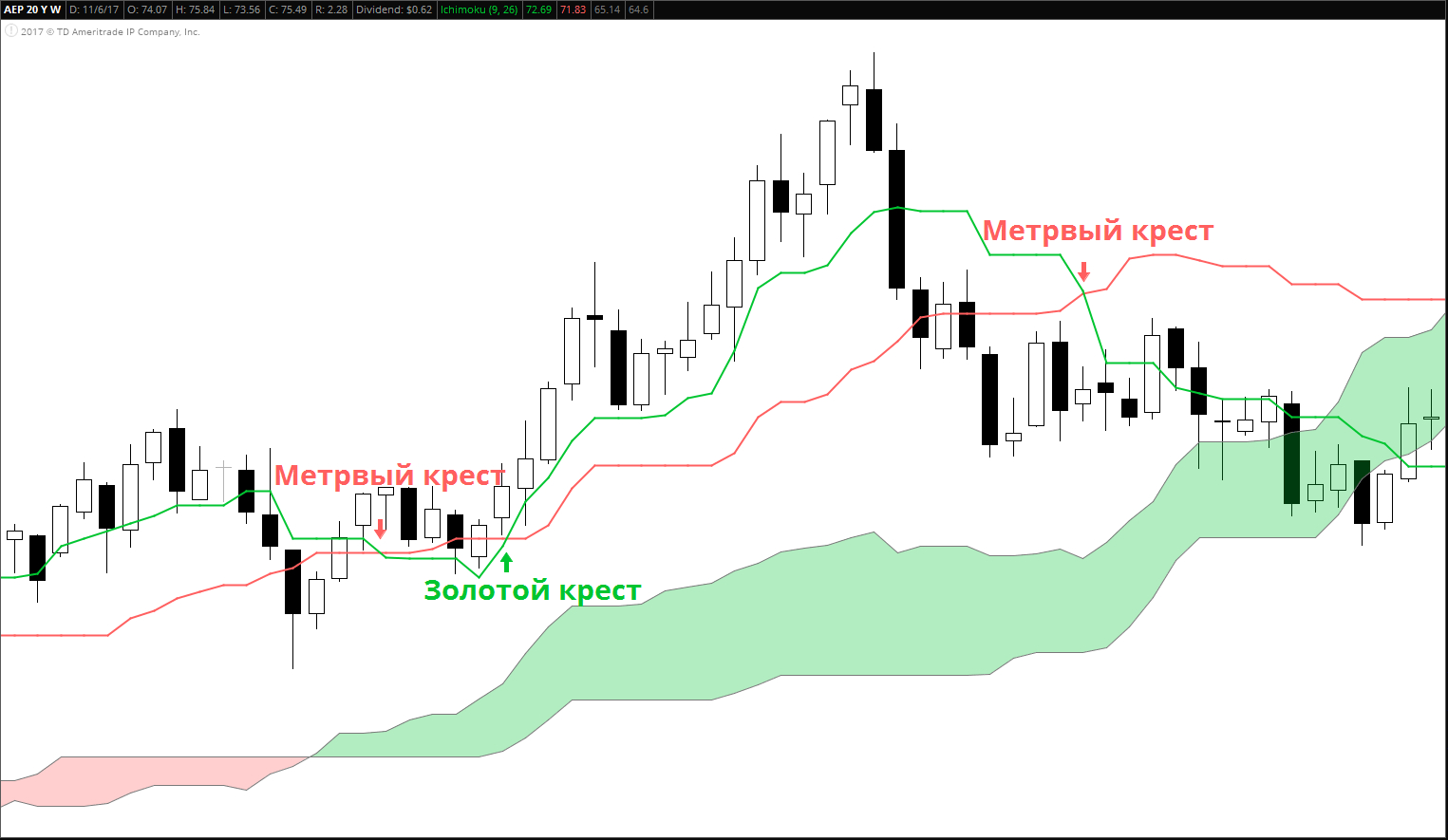

All a trader needs is to see the patterns in the image shown above and learn to identify them on a chart. This article will show you how to find these patterns and entries on a consistent basis. While trend detection is personal, there are ways to identify excellent trending behaviour of currency pairs.

The chart below shows a different combination—the 10-day/30-day crossover. The advantage of this combination is that it will react more quickly to changes in price trends than the previous pair. The disadvantage is that it will also be more susceptible to whipsaws than the longer-term 50-day/200-day crossover. Here are four different market indicators that most successful forex traders rely upon. Since currencies depend on macroeconomic movements, they aren’t susceptible to risks such as individual company stocks occurring at the micro economy level.

What Are Trends?

Once they drop below zero levels, consider it as a bearish reversal of the market trend. Moreover, this indicator also demonstrates the Directional Index of the price that provides further confirmation of the market trend direction. The +DI represents the strength of a bullish trend, and the -DI shows the strength of a bearish trend. For example, the +DI above -DI indicates the price is moving in an absolutely bullish trend. Swing high is a technical analysis term that refers to price or indicator peak.

- Thus traders should exit when the histogram crosses above the MACD as it may indicate a possible bullish reversal.

- This will allow you to categorize trend lines based on their strength and avoid getting baffled by contradictory signals.

- It’s a technical drawing tool that uses three parallel trendlines to identify levels of support and resistance.

- With the knowledge gained from this post, you’ll have all the information needed to make smarter decisions regarding your investments – no matter what year we’re in.

It is often easiest to identify a trend by drawing forex trendlines. A popular trading expression is “the trend is your friend.” This expression has stood the test of time because trends are critically important to any trading plan. Forex trendlines can be seen in almost any charting analysis due to its usefulness and simplicity.

It’s not easy to distinguish a trending market, mainly because of strange price behaviours even on long time frames. To easily locate trends, traders use some indicators or tools that help distinguish the price movement of trending currency pairs. The most famous of these indicators are the Simple Moving Averages, and the 20SMA, the 50SMA, and the 200SMA are the most common. This is one of the better trading tools that a trader will ever get.

What’s the Relationship between Trending Ranges and Interest Rate Differentials for Cross Pairs?

Some https://forexhero.info/ will just connect closing prices, but others will use a combination of close, open, and high prices. The angle or slope of trendlines indicates the strength of a trend. They are a useful and relatively simple tool for traders when utilized correctly. A trend is always easier to see once it is established, so aiming to capture a move in its entirety is often unrealistic. Most traders aim to capture the majority of a trend rather than its exact top or bottom. Trend lines help to smooth out the oscillations within a market’s price action, enabling you to plot the rough course of any movement.

In other words, we need to turn the price action you see in the chart above into actionable information. The market is powered by traders buying and selling, and that is what causes the different responses that you see in trends. Traders will make irrational emotional decisions creating the simple trends you expect to act out of the ordinary. Step 1 Identify higher highs and higher lows for an uptrend or lower lows and lower highs for a downtrend. If the price moves above the previous high then that is a higher high, look at the image below to see how it works. Conversely, a trader holding a short position might consider taking some profit if the three-day RSI declines to a low level, such as 20 or less.

Chart Art: Bullish Correction Levels on EUR/JPY and GBP/JPY

But it is much more important to understand the big picture and make well-rounded bets than it is to obsess over better methods for drawing trend lines. Once the 15-minute trend line has been drawn, we move on to the 5-minute chart. This will be our medium-term time frame that we can draw up and adjust the thickness like before. At the beginning of this guide, we explained that time frames are interconnected. These will have significant “room to the left” as they are located at price levels where the market has not traded in some time. Even though you are analyzing one time frame, it is possible to see trends belonging to other time frames.

- Counter-trend strategies rely on the fact that most breakouts do not develop into long-term trends.

- Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

- Traders will make irrational emotional decisions creating the simple trends you expect to act out of the ordinary.

Counter-trending styles of trading are the opposite of trend following—they aim to sell when there’s a new high, and buy when there’s a new low. You can enter a short position when the MACD histogram goes below the zero line. If your Forex trading strategy is well-reasoned and back-tested, you can be confident that you are using a high-quality Forex trading system that works for you. That internal confidence will make it easier for you to follow the rules of your Forex strategy and therefore, help to maintain your discipline. A trendline angle needs to be adjusted often, especially on shorter timeframes. Traders use trendlines to ensure that the underlying trend of an asset is in their favor.

The Aroon Indicator is one of the lesser-known but powerful trend indicators in existence. Built by Tushar Chande in 1995, it is mainly used for identifying changes in the underlying trend. It is unlike other trend indicators It consists of two lines and appears at the bottom of a chart.

But the risk is still present in all forms of speculation, and you shouldn’t range a trending pair without stop loss. Employ a reasonable stop at the half amplitude of that pair’s entire range, stopping before the range is broken. Each time the RSI reaches an extreme at the 90-plot guide, it provides a sell opportunity while the trend is downward and prices are below the channel. Each time the RSI reaches the 90-plot guide, the price has also moved back to the channel providing a new opportunity to sell in the direction of the trend. In the chart below, the Canadian dollar strengthened against the U.S. dollar during the period 2009 to 2011.

While https://traderoom.info/ of all experience levels can use this system, it can be beneficial to practice trading on an MT4 demo account until you become consistent and confident enough to go live. It can be applied to all currency pairs and is best on Major currency pairs. When it comes to timeframes, It works best on the M30 and 4-hour timeframes. However, the TW System can be traded on all other timeframes with similar success.

It also presents a vast range of technical indicators as Linear Regression, CCI, ADX and many more. Enter and Let Run – This strategy is for the most conservative traders who don’t like to risk much or take risks very often. As the name indicates, it consists of placing a trade after identifying the trend and letting it run its course. These kinds of trades, being conservative trades, are usually placed after the trend is confirmed, typically after the support line on the daily chart is broken.

When trading, we should be flexible and react to the actions of the market. Market data is provided byNYSE,ICE,CME Group,NASDAQ,IEX,CBOE,Barchart Solutions,Polygon,Benzinga,Intrinio,Quiver Quantand others. Real-time and historical price data for most listed securities is delivered via ICE Data Services. Marked the entry, target and stop loss as well using @TrendSpider positioning tool. Additionally, traders can sell spikes after a death cross between MA and the MA and buy dips after a golden cross.

March forex seasonals: What do the seasonals signal? – ForexLive

March forex seasonals: What do the seasonals signal?.

Posted: Tue, 28 Feb 2023 20:38:00 GMT [source]

Euro/yen cross with 50-day and 200-day moving averages and MACD indicator. When the current smoothed average is above its own moving average, then the histogram at the bottom of the chart below is positive and an uptrend is confirmed. On the flip side, when the current smoothed average is below its moving average, then the histogram at the bottom of the figure below is negative and a downtrend is confirmed.

This strategy typically uses low time-frame charts, such as the ones that can be found in the MetaTrader 4 Supreme Edition package. This trading platform also offers some of the best Forex indicators for scalping. The Forex-1 minute Trading Strategy can be considered an example of this trading style. The Get Profit Trading System is worth adding to your forex trading collection but remembers to have realistic expectations. However, like any other technical analysis tool, it cannot provide accurate signals 100% of the time.

The ADX trend indicator is used to measure the strength of a trend, a key piece of information to almost all traders. During strong bullish conditions, traders may decide on skip selling at resistance, hoping that the price might go through it if the trend is strong. However, buying into support may not be wise for a trader during strong bearish trends. As always, to achieve good results, remember about proper money management. To be a profitable trader, you must master discipline, emotions, and psychology.

https://forexdelta.net/ and resistance indicators are essential tools in Forex and CFD trading. Support and resistance trading has numerous applications, not only in Forex but also in other financial markets. This article will teach you 5 of the best support and resistance indicators, as well as a detailed explanat…

Note how the market tested this level as support on four separate occasions since its inception. What many traders tend to dismiss, however, is the shorter time span between each retest as the trend extended higher. Someone at some point in time came up with the notion that support and resistance levels become stronger with each additional retest.

Here, we take a look at how trends work in technical analysis, how to identify them and more. At any rate, the idea here is to watch how the market responds to support or resistance within a given period. A typical period would be a few days or maybe a full week if trading from the daily time frame. There is a common misconception among traders in all markets where technical analysis is a traditional method of trading. Notice how over the course of several months, GBPUSD carved out somewhat of a rounding top, which is a valid technical pattern. However, for purposes of this lesson, we’re only interested in using the swing highs and lows to identify a possible change in trend.

However, it’s important to note that tight reins are needed on the risk management side. These Forex trading strategies rely on support and resistance levels holding. But there is also a risk of large downsides when these levels break down.