Contents:

Once you have shortlisted the assets, you would want to backtest your trading strategy. You can get the data from the data vendor or from your broker. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 75% of retail client accounts lose money when trading CFDs, with this investment provider. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

Manually backtesting also becomes more tedious if you try to assess multiple timeframes. A positive result will help you have more confidence in such a strategy. Analysts use backtesting as a way to test and compare various trading techniques without risking money. The theory is that if their strategy performed poorly in the past, it is unlikely to perform well in the future . The two main components looked at during testing are the overall profitability and the risk level taken.

How do you backtest a model?

Backtesting a risk model, for instance, is typically done by checking if actual historical losses on a portfolio are very different from the losses predicted by the model. If actual losses are consistently higher, the model is underestimating risk. If they are lower, the model is overestimating risk.

Use runBacktest to run the backtest using the test data partition. Use the runBacktest name-value pair argument ‘Start’to avoid look-ahead bias (that is, “seeing the future”). Running the backtest populates the empty fields of the backtestEngine object with the day-by-day backtest results. Set the rebalance what skills are required to work with help desk system frequency and lookback window size are set in terms of number of time steps . Since the data is daily price data, specify the rebalance frequency and rolling lookback window in days. To use the strategies in the backtesting framework, you must build backtestStrategy objects, one for each strategy.

Biases Affecting Strategy Backtests

Maxima/Minima – Certain trading strategies make use of extreme values in any time period, such as incorporating the high or low prices in OHLC data. However, since these maximal/minimal values can only be calculated at the end of a time period, a look-ahead bias is introduced if these values are used -during- the current period. It is always necessary to lag high/low values by at least one period in any trading strategy making use of them. Optimisation bias is hard to eliminate as algorithmic strategies often involve many parameters. “Parameters” in this instance might be the entry/exit criteria, look-back periods, averaging periods (i.e the moving average smoothing parameter) or volatility measurement frequency.

How can I backtest?

- Define the strategy parameters.

- Specify which financial market and chart timeframe the strategy will be tested on.

- Begin looking for trades.

- Analyse price charts for entry and exit signals.

- To find gross return, record all trades and tally them up.

Thus, different trading systems can be tested and traders can practice without risking their budget with a live account. After a trader has decided on the strategy that fits best to his portfolio and his plans, he needs to choose the type of asset on which the strategy should be backtested. The most reasonable is for the trader to choose the asset that is in his plans to invest on with real money. For example, if the asset that the trader is interested in is a currency pair, he needs to find and download data that are referred to this exact pair and run his model over it. Backtesting is considered to be one of the most important mechanisms in the trading market. This is why it plays a crucial role in developing an effective trading strategy that traders can optimize without any risk and spot any theoretical or technical errors.

For this example, use one year of asset price data from the component stocks of the Dow Jones Industrial Average. All you need to do is select “Add Indicator” and choose the ones you want to use for your trading strategy. Backtesting a strategy may need to use pieces of past information that may be insufficient.

Incorrect offsets of these indices can lead to a look-ahead bias by incorporating data at $N+k$ for non-zero $k$. ᏟᖴᎠs are complex instruments and come with a high risk of losing money rapidly due to leverage. Repeat the process until you find another possible trade setup and then go back to step 3. Check the chart candlestick by candlestick looking for setups in line with the strategy you are testing. The information on this website does not constitute financial advice, investment advice, or trading advice, and should not be considered as such.

Use hindsight to your advantage with 40+ years of market data

This is why every strategy should be accompanied by sensible risk management. Backtesting can help your crypto trading strategy when you carry it out correctly. In determining which is better between manual and automated backtesting, you must consider different factors like how much time you have to backtest, your personality, etc. On the flip side, manual backtesting is time-consuming as you will need to analyze a lot of historical data to get your results. It is also easy to make mistakes when tracking your past data or the results.

- As new data becomes available, the average of the data is computed by dropping the oldest value and adding the latest one.

- These factors can substantially tilt the upside or downside and provide ineffective results after backtesting.

- In the Strategy Tester window, you can configure the settings for your backtest by clicking the settings wheel next to the strategy’s name.

- You’ll observe the charts and detailed report of that strategy over the period tested.

- This includes the asset class you are trading and the chart timeframe.

The backtestStrategy rebalance function uses this information to compute the desired new portfolio weights, which are returned to the backtesting engine in the function output new_weights. See the Local Functions sections for the rebalance function for each of the five strategies. Once having counted the gross return, traders need to segregate the trade commissions and various trading costs so they will estimate the worth of their net return. A net return is defined as the combination of the profits and losses due to a specified time frame. Backtesting a trading strategy gives traders the chance to use different features of this mechanism such as re-testing or optimizing a strategy until they adjust it to their needs and future goals.

Backtesting Trading Strategies

We will use pandas rolling and mean methods to calculate a moving average. We will follow the below steps to backtest the above trading strategy. When the short-term moving average (50-day moving average) crosses above the long-term moving average (200-day crossover), we buy the security. MATLAB – MATLAB is another programming language with multiple numerical libraries for scientific computation.

Benchmarking deep neural networks for low-latency trading and … – Risk.net

Benchmarking deep neural networks for low-latency trading and ….

Posted: Mon, 06 Mar 2023 08:00:00 GMT [source]

If you would like to go back to the backtest page to change the contracts, click on the red button right above the y axis. Figuring out which programming languages can be used to code the trading strategy which is to be tested. It’s a simple fact, after the year 2000, the companies which survived did well because their fundamentals were strong, and hence your strategy would not be including the whole universe. Thus your backtesting result might not be able to give the whole picture. Volatility and maximum drawdown are the standard measures of risk. If you are concerned about the maximum loss a strategy can incur over a period of time.

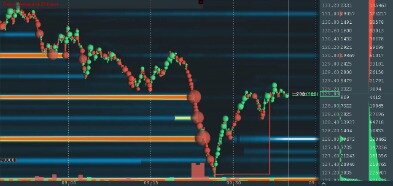

Visualize trading decisions on the price chart.

It is a key component in developing an effective trading strategy. There are infinite possibilities for strategies, and any slight alteration will change the results. This is why backtesting is important, as it shows whether certain parameters will work better than others.

Upon choosing the duration, you can then select the legs of the strategy you want to backtest. The calls are on the left hand side of strike and the puts are on the right hand side. The outermost columns on either side are the delta values, and the inner columns are the bid and ask. And run your strategy on the test dataset with the same parameters that you used on the training dataset to ensure the effectiveness of the strategy. You created the strategy and analysed the performance of the strategy. You take the first three years of data and calculated moving averages.

However, this may always not be the case because markets are always dynamic and ever-changing. The average-gain/loss statistic, combined with the wins-to-losses ratio, can be useful for determining optimal position sizing and money management using techniques like the Kelly criterion. Traders can take larger positions and reduce commission costs by increasing their average gains and increasing their wins-to-losses ratio. TradeStation – TradeStation has always been a leader when it comes to automated trading.

How to Identify Stocks with the Best Profit Potential – Yahoo Finance

How to Identify Stocks with the Best Profit Potential.

Posted: Wed, 15 Feb 2023 08:00:00 GMT [source]

There is a famous example that is used to illustrate the survivorship bias. You keep repeating this process until you’ve reached the end of the data. As new data becomes available, the average of the data is computed by dropping the oldest value and adding the latest one. This hypothsesis states that securities that have positive returns over the past one year are likely to give positive returns over the next one month.

If an unsupported indicator is used, the backtest will be performed based on the price action strategy. A streak subscription is required to run more than ten backtests and edit the strategies. An additional analysis of the strategy backtesting results can be done in Excel, where you can upload all your filled trades using the export from the Trades panel. Select the testing range, and also set the initial balance of $10,000 in the module settings. Note that after adding each new instrument , it is assigned a separate trading account.

The best backtest strategy will depend on your trading personality, overall goals and level of experience. Below are two methods that you could consider using as part of a backtesting template. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Through this we get a realistic expectation of the performance of the strategy. When your expectations of the profits, drawdowns and win rate are set right, you get the confidence to give https://day-trading.info/ your strategy the independence to allow it to run live, on auto pilot on Tradetron. All the positions taken by the strategy during the backtesting period are displayed under this.

Without a doubt, an effective automated backtesting system will help you enter the markets with a tested and successful trading strategy without risking your capital. The trading platforms are efficient instruments traders can use to backtest their trading strategies with different assets. It is the most widespread backtest mechanism and is used not only by new investors but also by the most experienced ones.

Can you backtest on TradingView for free?

you can do charting create alerts create strategies and of course, you can do backtesting. Now there are a couple of reasons why we are using the trading view. Number one is that it's free.